Why Bitcoin is Stupid

Issue #1

Let me set the stage…

January 2, 2018.

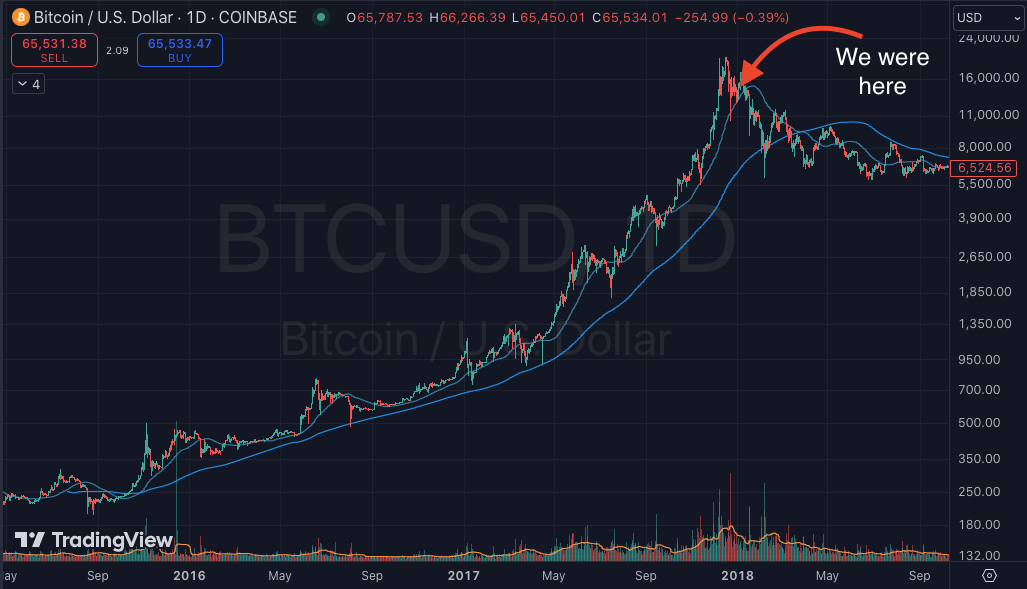

Bitcoin had recently completed a multi-year parabolic bull run that took it from $200 to $20,000. The price was trading around $14,000, bouncing off a gut-wrenching correction that cut it in half over the course of the few days before Christmas.

When bitcoin rallies hard, people take notice…lots of people…new people who haven’t done the work to understand it and the important problems it solves.

Such is the case for one of the granddaddies of the FIRE movement, Mr. Money Mustache, who posted a piece on his blog entitled Why Bitcoin is Stupid on that date at the beginning of 2018.

We’ve all been there

To most people, bitcoin looks stupid at first. It’s unlike anything we’ve ever seen, so the natural inclination is one of skepticism. Rightly so. The mere assertion that a new tool will completely revolutionize the global financial system and overhaul money itself sounds crazy when taken at face value.

Bitcoin is unintuitive at first. It’s easy to dismiss as digital beanie babies or a tulip bulb bubble, two very unoriginal comparisons that Mr. Money Mustache makes in his piece.

Only after approaching bitcoin with intellectual curiosity and putting in some mental work does it start to make sense. Bitcoin goes from unintuitive-at-first-glance to hyper-intuitive after serious investigation.

It took me years to get there, which by all estimations resulted in millions (tens of millions?) of dollars of opportunity cost.

Here’s an abbreviated timeline of my bitcoin journey:

2011: first time hearing about it, “Sounds interesting!”, price ~$10

2014: bought my first bitcoin, $100/month for a few months, then stopped, price $250-650

2016: bitcoin trades at nominal parity with gold, “Look honey, how cool is that!?”, still not buying more, price ~$1,600

2018-2019: I finally started to do the work to understand bitcoin, initiate dollar-cost averaging (DCA), price between $3k and $14k

2020+: fully convicted, DCA + all extra excess capital allocated to bitcoin, price today ~$63k

I never really thought bitcoin was stupid, but I certainly didn’t take it seriously enough early enough. Many such cases. 🤦♂️

Bitcoin is stupid, and that’s the point!

It’s not stupid in the way MMM means it. I won’t rebut his “arguments” against it in this issue. Let’s save that for later.

Bitcoin works because of its “stupid” nature.

It has a fixed supply of 21 million, which doesn’t need to be managed by government bureaucrats.

It doesn’t care who you are or what your reputation is, whether you’re wealthy or poor, man or woman, what race or nationality, young, old, President or proletariat. Anyone who plays by bitcoin’s rules can use it as a tool for their own ends.

It can’t be manipulated or coerced or changed in any meaningful way. It’s not a “world computer” and mining bitcoin serves no other purposes than to back the system with real-world energy expenditure.

You can’t negotiate with it or convince a politician to change the rules in your favor or against the interests of your enemies. You can’t prevent Russia or China or North Korea or name-your-bogeyman from using it. Nor can they prevent you from using it.

Holding bitcoin simply means you have unilateral control over an absolutely fixed supply of “magic internet money”.

Bitcoin is beautiful because it’s stupid.

Fixed supply of 21 million, no human intervention needed or wanted.

No bias—permissionless regardless of who or where you are.

Unchangeable, uncompromising, and unmanipulatable.

Bringing bitcoin into a FIRE framework

I discovered the FIRE approach to personal finance around the time I restarted my bitcoin DCA in 2018/2019. The first entry in the spreadsheet I keep for tracking expenses, savings, and my progress to financial independence dates back to September 26, 2019.

At first, my favored primary tool for savings was stock market index funds. Excess earnings were immediately funneled in that direction, and my bitcoin DCA was secondary.

But as my understanding and conviction grew, bitcoin overtook index funds as the primary savings vehicle. The result: an accelerated timeline to financial independence. An aspirational goal of reaching FIRE in 10 years turned to reality in less than five.

FIRE BTC is meant to help others do the same.

As bitcoin gains adoption, people who take a FIRE approach to personal finance will undoubted take an interest in it. I’ve also noticed that bitcoiners are interested in learning how to implement a FIRE strategy for themselves.

Whether you’re a FIRE practitioner exploring bitcoin or a bitcoiner intrigued by financial independence, this newsletter is here to bridge the gap. We’ll explore:

How bitcoin fits within a FIRE strategy.

Educational topics on personal finance and bitcoin.

Spending, saving, and developing a roadmap to financial independence.

That’s it, thanks for reading the inaugural issue of FIRE BTC!

I’m here to help you navigate your FIRE journey with bitcoin and to incorporate bitcoin within it. Got a question or a topic you’d like me to cover? Let me know! And if you’re ready to dive deeper into bitcoin’s role in FIRE, hit subscribe below. 👇

Banger.

Great read