Last week, I gave a primer on the secret sauce of a FIRE strategy: the power of compounding. Below is a link if you haven’t had a chance to read it yet.

After exploring this concept, I gave a few tips to accelerate your FIRE journey. This issue focuses on the last tip I shared, which is to increase the rate of return on your savings portfolio. You won’t be surprised to hear that I believe bitcoin is the best tool for this job.

Today, we’ll explore what adding BTC can do to get your FIRE burning hotter!

🐳 A tale of two assets

It's an unfortunate reality that it's not enough to work and save without taking additional risk. Holding value in fiat money is a guaranteed way to lose purchasing power over time.

This means you must trade the dollars you earn for assets that will at least keep up with consistent rises in the cost of living. As I wrote in Bitcoin is FIRE Friendly, FIRE proponents and practitioners understand this fact intuitively.

Essentially, the mantra is “save and invest your way to financial freedom.” Problem is - most people are not good investors!

Even the professionals underperform the market most of the time.

In any event, diversified hedge fund investing appears to have underperformed in modern (post-GFC) times. For the 15 years ending June 30, 2023, the HFR Fund-Weighted Composite Index had an annualized return of 4.0%. This compares to a 4.5% return for a blend of public market indexes with matching market exposures and similar risk, namely, 52% stocks and 48% Treasury bills. By this measure, the hedge fund composite underperformed by 0.5% per year.

So how are you, Average Joe, supposed to work your job or run your business AND be a successful investor?!

The answer: if you can't beat the market index, join it!

The traditional FIRE approach trades the idea of investing for saving by simply buying an index fund that tracks the entire stock market. For many, myself included, the fund of choice is the Vanguard Total Market Index fund, ticker VTI.

Using VTI, or similar broad market index funds, solves several important problems for the FIRE-seeker:

No single investment risk - picking the wrong investment, a stock or otherwise, can lead to major losses. Exposure to the entire stock market means you’re betting on the resiliency of economic growth over time, instead of the prospects of a particular company or piece of real estate.

Easy to execute - just stack and chill. No need to spend hours every week analyzing balance sheets, revenue and cash flow forecasts, or P/E ratios.

Cost effective - VTI carries an extremely low expense ratio of 0.08%. You want to minimize the cost of maintaining your investment. Those fees add up over time and can provide significant drag on your returns.

Track record - the US stock market has a long history of compounded growth that enables a FIRE practitioner to build wealth faster than their cost of living increases. In The Power of Compounding newsletter issue linked above, I highlight that VTI returned over 12% CAGR over the last 8 years.

In fact, I often make the case that index fund “investing” is not investing at all. It’s merely an effective form of saving. This X post thread lays out my reasoning:

Which brings us to bitcoin………

If FIRE is about building a savings portfolio that can sustain your lifestyle, it makes sense to choose the best savings technology on the planet.

In addition to solving the same problems for the FIRE-seeker as VTI, bitcoin has other advantages: 24/7/365 liquidity, global accessibility, direct controllability, etc.

It also has a perfectly fixed supply and is undergoing rapid adoption as the world figures out just how important and valuable it is. This adoption cycle, which I expect to continue for quite some time, has led to massive outperformance of BTC relative to VTI.

Here is a chart that shows the performance of VTI priced in bitcoin:

🧐 The effects of a bitcoin allocation

Bitcoin is the ultimate savings technology, but if you’re still not as convicted on that statement as I am, you may consider starting with a small allocation that can grow alongside your conviction.

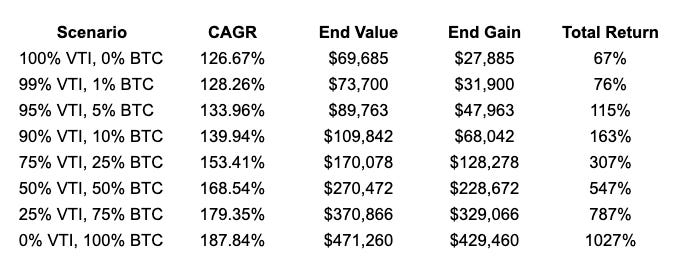

I put together a simple analysis to illustrate the effect of a bitcoin allocation on a FIRE portfolio. We know from the chart above that adding bitcoin would have increased your rate of return (and thereby reduced your time to reach financial independence), but what exactly does that look like?

The analysis explores various allocation levels using the two assets we’ve been discussing: VTI and BTC.

I chose an 8-year timeframe for two primary reasons:

8 years is realistic to achieve FIRE just by using VTI under some circumstances.

This represents 2 bitcoin halving epochs, which I believe should be the minimum holding period for any allocation to bitcoin.

The approach is straightforward. For each week starting 8 years ago, assume $100 saved, split in various ways between the two assets. Progressive BTC allocation scenarios show the varied effects on portfolio growth: 0%, 1%, 5%, 10%, 25%, 50%, 75%, 100%.

The chart below makes clear what we already know. Larger bitcoin allocations have led to significantly better returns over the last 8 years.

The 8 year period contains 418 weeks of $100 savings for a total of $41,800 saved. Here is a summary of the data.

Note: the table shows a modified CAGR that includes the weekly $100 contributions. In other words, this is the annual growth rate of the total value of the portfolio. This is OK, because from a FIRE perspective, we care only about our total portfolio value growing large enough to cover our annual expenses.

We can see that a 100% BTC allocation would have grown the portfolio almost 7 times the size of a 0% BTC allocation!

Another interesting highlight: the total return multiplier of adding BTC into the portfolio over the last 8 years was 9.61. For every 1% increase in BTC allocation, the portfolio returned an additional 9.61% in the total return column.

Of course, there are tradeoffs to everything. For a bitcoin allocation within a portfolio, that tradeoff comes in the forms of volatility and drawdowns.

💸 The cost of higher returns

The bitcoin price is notoriously volatile, and over the 8 years analyzed above, there were several very large drawdowns. Obviously, this will have an effect on the portfolio value temporarily.

Let’s look at four significant bitcoin drawdown periods that occurred within the analysis timeframe.

During these periods of downside volatility, the price of bitcoin fell by 84%, 72%, 55%, and 77% respectively. How is each allocation scenario effected, given consistent additions of $100 per week?

Of course, the first scenario with no BTC exposure is unaffected. While the stock market was only slightly higher at the end of this first BTC-drawdown period, the additional contributions helped the total portfolio value grow substantially. This is important to note, and you can see the effect of these contributions in the higher BTC allocation scenarios. For instance, the 25% VTI, 75% BTC strategy saw the portfolio value decline only 71% in the first drawdown period, compared with the 84% bitcoin price correction.

Early on in your FIRE journey, these types of price corrections should be welcomed. Your goal is to stack as much as you can as fast as you can.

As you get close to your FI number, however, deep drawdowns can create problems. This is known as sequence of withdrawal risk, which I will explore in the future.

The bottom line: you can ignore the volatility for most of your FIRE journey and be thankful for the extra value you’re able to accumulate because of it. When it comes to volatility, George Harrison said it best: “All things must pass…”

🔮 Looking ahead

If the past is indicative of the future, can we expect similar results over the next 8 years? I think it’s very possible…

There are many different opinions on what the future holds for both stocks and bitcoin. We seem to be at an inflection point in the global financial system. Debt levels and fiscal profligacy may have passed the event horizon, where the only realistic outcome is massive expansion of the fiat money supply.

Things seem to be accelerating, not slowing down. However, I’m generally not one for alarmism. It’s entirely possible that the next 8 years are still somewhat orderly in the macro-financial world.

But the trend is the trend. Even with a substantially lower CAGR, bitcoin provides substantial benefits within a FIRE portfolio.

Increasing your rate of return will get you to financial independence faster. In the past 8 years, more was better, and I expect the future to be very similar.

Ultimately, it comes down to personal choice. Everyone is different, and you should do what works for you and your family. Typically, people new to bitcoin are hesitant to allocate substantially to it. However, conviction breeds comfort. Most of the people I’ve met who have put in the work to understand bitcoin choose to allocate heavily.

That’s it for this week. Thanks for reading!

💡 Enjoyed this content? Share FIRE BTC with someone who’d love to learn about financial independence and bitcoin!

Until next week,

Trey ✌️

I’m starting to see a picture come together of a new Fire portfolio that maybe replaces bonds with bitcoin? 😃