We live in a world of credit-based money. Dollars are created from new debt and destroyed when debt is extinguished.

This symbiotic relationship has important implications. Without continuous expansion in global debt and the money supply, the financial system becomes unstable. This expansion leads to debasement of both debt and money.

In simple terms, new debt and new money debases existing debt and existing money. The value of both erodes as supplies of them increase.

This enables an interesting opportunity. Borrowing money at low rates to buy assets that grow at faster rates provides leverage in achieving financial independence.

Like it or not, credit is the lifeblood of the economy. Those with access to credit and an understanding of how to use it stand at a distinct advantage to those who don’t.

You don’t have to use debt to pursue FIRE, but a strategic approach can get you there faster.

⚔️ Introducing “speculative attack”

It’s a debt-based world, and you’re living in it. So why not use that to your advantage?

One of the more impactful pieces I read early in both my FIRE and bitcoin journey was written by Pierre Rochard and posted on the Nakamoto Institute website back in 2014. It’s called Speculative Attack.

The essence of conducting a speculative attack is to borrow in a weaker currency to buy a stronger one. From the essay:

How leveraged someone’s balance sheet is depends on the ratio between assets and liabilities. The appeal of leveraging up increases if people believe that fiat-denominated liabilities are going to decrease in real terms, i.e. if they expect inflation to be greater than the interest rate they pay. At that point it becomes a no-brainer to borrow the weak local currency using whatever collateral a bank will accept, invest in a strong foreign currency, and pay back the loan later with realized gains. In this process, banks create more weak currency, amplifying the problem.

Similarly, people unknowingly perform a speculative attack when they buy a house with a mortgage (especially if it carries a low rate).

In 2020, as the COVID ordeal kicked into full force, mortgage rates plummeted. Many people refinanced their homes with 30-year fixed rate mortgages under 3%. Shortly thereafter, interest rates skyrocketed as the year-over-year consumer price index (CPI) hit 9%.

The value of those mortgages fell off a cliff, and any investors holding that paper sustained huge losses during that period.

For the borrowers, of course, this was a great deal. By locking in a basement bottom rate for 30 years, they free up cash flow to invest in assets returning well above 3%. Not to mention, the massive money printing bonanza caused the price of those homes to drastically increase in value. The loan becomes easier to pay off over time, and those borrowers are much wealthier versus the alternative option to pay off their homes.

They gained leverage, using the reality of the fiat financial system for their benefit.

🥋 Aikido Finance

Aikido is a Japanese martial art that focuses on redirecting an opponent’s energy rather than meeting it with direct force.

Rather than opposing the fiat financial system or hoarding fiat currency, a speculative attack leverages the system's reliance on debt and inflation. By borrowing fiat money (credit) and converting it into hard assets (like bitcoin), practitioners exploit the fiat system's inherent weaknesses, particularly its tendency to devalue over time through inflation.

Transforming liabilities into assets allows you to grow wealth from both sides of your balance sheet. This is especially true for a home mortgage, because you end up owning two assets instead of just one.

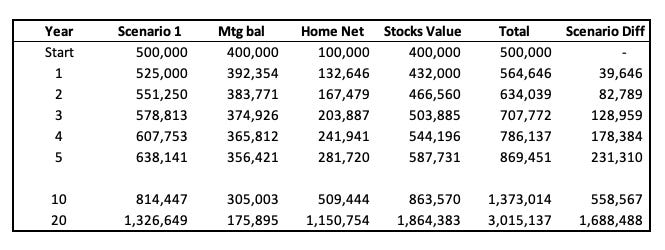

For illustrative purposes, let’s play out two different scenarios for the purchase of a $500,000 home back in 2020.

Scenario 1: paying cash

Paying cash means you end up with a $500,000 home as an asset. Your cash balance has also dropped by the same amount.

You’ve transferred an asset that loses 7% per year in real value into an asset that gains (let’s say) 5% nominal value per year.

So after 5 years, the home is worth close to $640k, a gain of about 27%. After 10 years, it’s worth $815k (63% increase), and after 20 years, it’s worth $1.3 million (165% increase).

Scenario 2: mortgage

Instead of paying cash for the entire purchase price, let’s assume you finance the home with a 30-year fixed rate mortgage at 3% with a 20% down payment.

Now your cash outlay is only $100,000, and the remaining $400,000 can be used to buy bitcoin. That would have bought 40 BTC at an average 2020 price of $10k!

So now you have a $500k asset (home) with a $400k liability (mortgage) plus an additional 40 BTC. At this point, you’re in the same starting position as the first scenario.

Of course, you’ve also taken on a monthly principal and interest payment of $1,686 per month, $20,232 per year.

Although bitcoin has historically gained 50-70% per year on average, the lowest average return for a 4 year period is ~25%. We’ll use that conservative number for this analysis.

Here’s what the numbers look like for scenario 2 😳:

Ok, I know what you’re thinking. That’s insane.

On one hand, you’re right. On the other hand, I laid out my (IMO conservative) assumptions above and simply ran the numbers.

If you take the same scenario for buying stocks instead (assume 8% annual growth), the effect is similar, just way less amplified.

Regardless of the asset you choose to purchase with the capital freed up by taking a mortgage, this Aikido finance technique uses the momentum of the fiat world to get you to your goal faster.

By the way, I don’t consider my home equity as part of my savings portfolio that counts towards reaching my FIRE goal. While it’s countable in your net worth, that capital is locked up and unable to be used to cover expenses.

A mortgage allows you to unlock that capital and transfer it to assets that are liquid and available to pay your bills.

⚠️ The obligatory words of caution…

Yes, of course, carrying debt includes risk.

You must be able to handle the monthly payments of a mortgage. Someone with a paid-off home will have a lower FIRE portfolio goal because a mortgage payment adds an ongoing expense.

In the example above, carrying the mortgage would increase your annual expenses by about $20k. Using the 4% rule, that means your savings portfolio must be larger by about $500k to achieve FIRE.

However, 80% of that amount is immediately invested, so the shortfall is only the $100k downpayment needed to make the purchase. You’ll make up for that quickly through your normal intentional savings plan as a FIRE practitioner.

Most people pursuing FIRE don’t just have $500k laying around to buy a house anyway.

The above example is meant to illustrate the advantages gained by having fiat-denominated debt. Some personal finance gurus, like the inimitable Dave Ramsey, advocate for eliminating all debt, including a mortgage.

While this might be the right choice for some, I prefer to lean into my understanding of the way our credit-based financial system works to maximize my family’s wealth and achieve FIRE faster.

Mortgages are not the only opportunity to practice Aikido finance. The same approach can be applied to other purchases, such as cars and other consumer items.

I’ll dive into more detail on that in a future issue of the newsletter.

That’s it for this week. Thanks for reading!

💡 Enjoyed this content? Share FIRE BTC with someone who’d love to learn about financial independence and bitcoin!

Until next week,

Trey ✌️