🏛️ Build Your Strategic Bitcoin Reserve

FIRE BTC Issue #7 - Front-run the US government to secure financial freedom

The US presidential election is behind us, which means we can finally turn the TV on without being inundated with political ads.

It was a resounding victory….for bitcoin!

With a red sweep of the White House and both houses of Congress, we can expect the political and regulatory environment as it relates to bitcoin to move from antagonistic to supportive, or at the very least more laissez faire.

Bitcoin’s anti-fragile nature allows it to benefit from hostility. You can argue that it is as strong as it is today because of the adversity the network has faced in its first 15 years. Bitcoin doesn’t need a conciliatory environment for its global adoption to grow, but it certainly doesn’t hurt to have one.

The past 12 months has seen a massive shift in the perspective of corporate and political leaders toward bitcoin. With this supportive landscape in place, one particular proposal has received a lot of attention: a US Strategic Bitcoin Reserve.

💰 What is a strategic reserve?

A strategic reserve is a stockpile of essential resources or commodities that a country, organization, or even an individual holds in reserve to be used in times of emergency or shortage. The purpose is to ensure stability, security, and continuity of operations during unforeseen disruptions or crises.

The US government already has several important strategic reserve programs:

The Strategic Petroleum Reserve (SPR) holds enough crude oil to supply domestic needs for several months if oil imports were impeded.

The National Defense Stockpile (SDS) holds resources vital for defense manufacturing and technology in the event of supply chain disruptions.

Gold reserves are held by the US Treasury (mostly in Fort Knox) to backstop the nation’s creditworthiness and the credibility of the dollar.

Reserves are not just for governments.

Companies generally hold cash reserves to weather economic downturns or fund acquisitions. In fact, a few companies like MicroStrategy, Tesla, and Block, already hold bitcoin as a key asset on their balance sheet.

Most personal finance advocates suggest a strategic reserve of liquidity, mostly cash, to ensure you can pay your bills if you lose your job or have some other income interruption. The general recommendation is to hold three to six months worth of expenses.

🏁 The race is on

Senator Lummis of Wyoming has introduced a bill that would establish a US Bitcoin Strategic Reserve (SBR). The essence of the bill is to

Keep the bitcoin it already holds as a result of enforcement actions and seizures (200k+ BTC)

Implement a bitcoin acquisition program to reach 1 million BTC held

Hold bitcoin in the SBR for a minimum of 20 years to be used for the purpose of paying down federal debt.

This proposal appears to have support from the Trump administration. Needless to say, this would be a game-changer.

A bitcoin-friendly US government, a ballooning global debt situation, and an increasingly polarized world order suggests bitcoin will be adopted more rapidly going forward.

The “problem” is that bitcoin enjoys a unique property: absolute scarcity. There’s only so much to go around, which means adversarial nations, corporations, and individuals like you and me all must compete to secure a share of the pie.

It’s a global game of musical chairs.

With the US embracing bitcoin, other jurisdictions will be forced to reassess their stance.

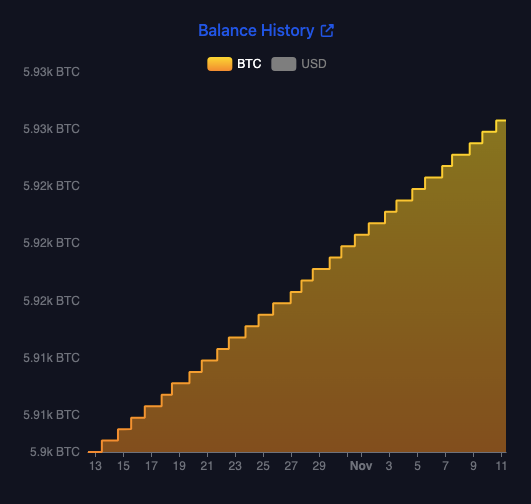

Some nations, like El Salvador, are ahead of the curve. In September of 2021, the small Central American nation adopted bitcoin as legal tender and has since acquired a nice little stockpile of their own. El Salvador buys one bitcoin every day as part of its policy and currently holds just shy of 6,000 BTC.

The Himalayan nation of Bhutan has been mining bitcoin as a way to build its strategic bitcoin reserve. It has apparently been doing so since 2019 and has amassed a position larger than El Salvador’s.

Other countries are becoming more friendly to bitcoin and bitcoin mining, and headlines continue to drop where attention is being paid: Ukraine, Russia, Khazakstan, UAE, Madeira, Argentina, etc.

Adversarial nations to the US will need to react with their own plans if the US leads the way on bitcoin adoption. They can’t afford to be at a strategic disadvantage. It appears the BRICs coalition has entered the game as well.

🧱 Build your own SBR

The floodgates appear to be opening. If you’re a FIRE practitioner with zero allocation to bitcoin, you should consider building your own Bitcoin Strategic Reserve.

Perhaps a good place to start is to match the value of your cash emergency reserves. Someone who spends $8,000 each month may have three months of expenses, or $24,000, set aside for emergencies or other unforeseen circumstances such as a lost job. Aim to reach a commensurate value for your SBR by diverting some or all of your excess monthly savings to bitcoin.

When this level has been reached, you will have secured a seed position that can either be maintained over time or added to. As you get comfortable with bitcoin’s volatility, start to understand the asset better, and see the value of your SBR grow, you will likely want to continue saving in bitcoin.

Regardless, you will have front-run the big money. Nations and large corporations are slow to get off the starting line. Individuals are in the fortunate position of having the ability to be nimble.

You can’t opt out of this race, so you might as well give yourself a head start.

That’s it for this week. Thanks for reading!

💡 Enjoyed this content? Share FIRE BTC with someone who’d love to learn about financial independence and bitcoin!

Until next week,

Trey ✌️

Another great article! So many huge catalysts on the horizon. I love the idea of a personal Bitcoin strategic reserve. If the USA does adopt a SBR, it has the potential to change the way we all think about Bitcoin and how we want to hold and use it.